Who advises the adviser?

A second opinion never hurts, especially in an industry as volatile as financial services.

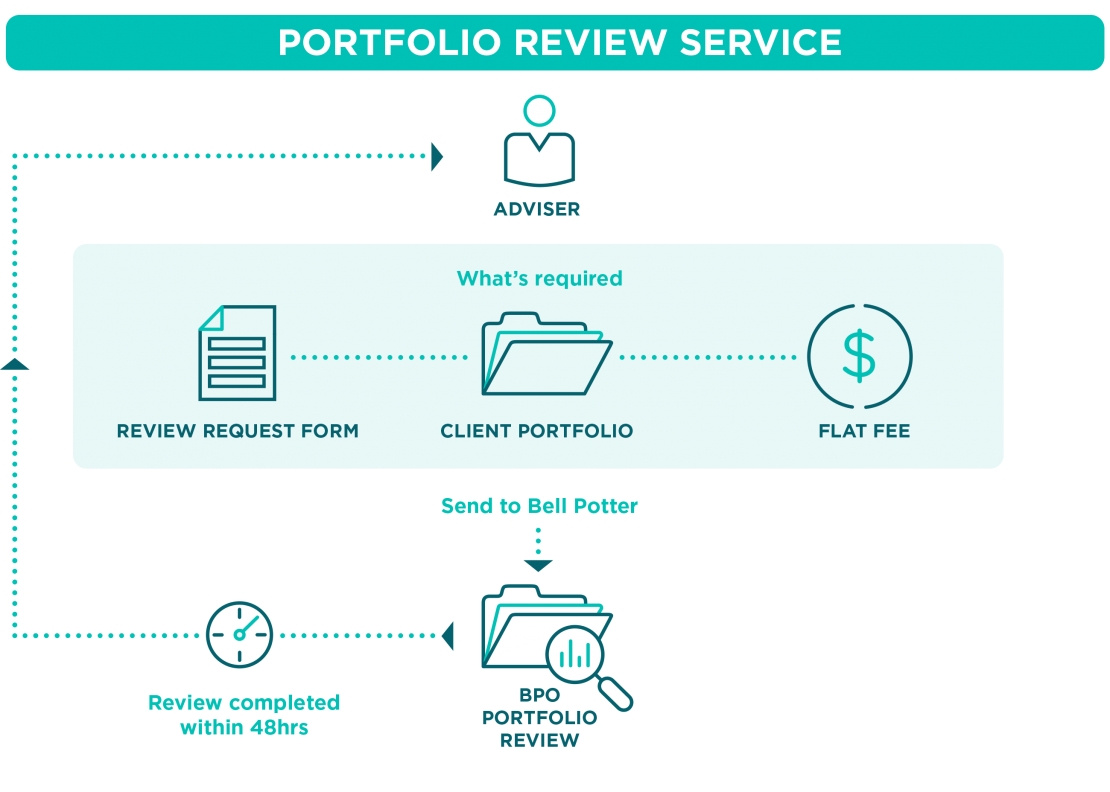

Given the vast array of products and markets available to clients' portfolios, it's understandable that advisers can occasionally be asked to review portfolios which are outside of their field of expertise. Rather than either denying the client of service in these fields, which in turn bleeds clients to their competition, wouldn’t it be better to have a second, highly skilled and specialised opinion?

With over 20 years' experience in reviewing portfolios, the Bell Potter online team are the team to help formulate that opinion.

Paul Ashworth has worked closely with financial planners and intermediaries over the last 15 years to help design, monitor, and implement a range of direct investment strategies. Paul holds a Graduate Diploma of Applied Finance from Kaplan.