In her November review, Julia discusses:

- Market performance and short covering (0:26)

- Best & worst performers review (0:52)

- Portfolio strategy in a synchronised world growth (1:30)

- December index rebalance forecast (2:57)

- December outlook (3:38)

With the market rallying hard in the last few months of the year, some of that will be due to short covering. One of the big short covering moves include Syrah Resources moving from 28% of its stock being shorted a month ago, down to 21% in November.

The best performers in the ASX200 was Syrah (SYR), up by 29%, and Orocobre (ORE) up by 27%. On the flipside, some of the worst performers included Fairfax Media (FXJ), down by 38%, and Orica (ORI), down 16%.

The MSCI Index which measures the global stock market, is up 19% YTD.

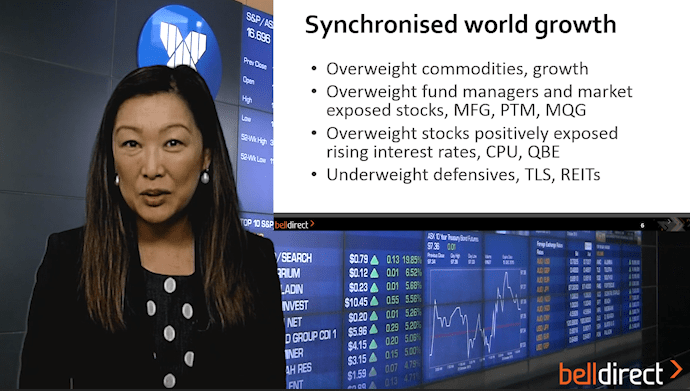

Double digit gains is usually a positive sign for traders with a bullish outlook expected. When you see synchronised world growth, you want to be positioned for growth. That means being overweight commodities, fund managers and market-exposed stocks as well as stocks positively exposed to rising interest rates. And you want to be underweight in defensives, the property sector and the utilities space.

One of the major events on the calendar in December will be the S&P rebalancing of indices on 8 December. Macquarie forecasts stocks such as Lynas (LYC), Wisetech (WTC), Pilbara Minerals (PLS) and Smartgroup (SIQ) to be added to the benchmark ASX200 index. Stocks most likely to be deleted include FlexiGroup (FXL), Japara Healthcare (JHC), Regis Healthcare (REG), Asaleo Care (AHY) and Lyer Holdings (MYR).

In terms of the outlook for the month of December, the last two weeks of December tend to be extremely positive for the market.