In her October review, Julia discusses:

- October: best monthly performance in 2017 (0:15)

- Fundamentals vs. short covering (3:19)

- Bank earning season review (3:51)

- Strong global growth reflected in metals (4:47)

- Positioning for growth: sectors to look at (5:34)

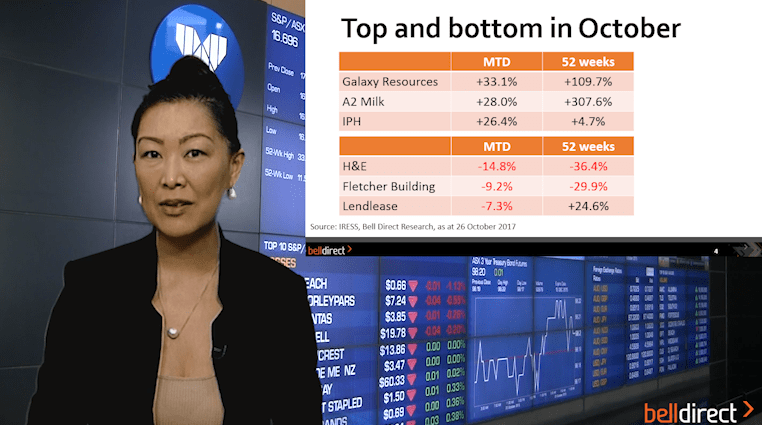

All sectors have traded higher in October with information technology the best performing sector (up 8.3%). Two of the best performing stocks in September (Galaxy Resources and A2 Milk) have outperformed again in October.

The worst performing stocks (H&E, Fletcher Building and Lendlease) have all been hit by profit downgrades due to lost contracts.

We've broken out of the trading range we saw these last five months and are now approaching peaks for the market in 2017. Mid caps displayed the highest returns with +11.8% YTD.

Is the market currently running on fundamentals or is it due to short covering? As long as the market continues to run, we should see the most shorted stocks being well supported with strong gains coming through.

On the banks' recent results, Bank of Queensland looks fully valued whilst ANZ came out with a softer outlook and a buyback announcement.

The current strong global growth is the best we've seen in the last six years and is being reflected in the metals players.

If you're looking for growth, you should be overweight in mining, fund managers and interest rates and underweight in defensives.