The Australian share market is delicately poised, leaving some investment experts believing now is the time to buy up stocks and reap the benefits of a looming snapback in prices.

The ASX200 has had a remarkable few months as the coronavirus pandemic ground the economy to a halt.

It is in the rare position of being both a bear market having plunged more than 20 per cent from its all-time high on February 20 while at the same time classified as a bull market after rising more than 20 per cent from its horrific depths on March 23.

So where to from here?

Bell Direct market analyst Jessica Amir has urged Aussies to jump in, saying a recovery is a matter of when not if.

“Taking advantage of depressed prices can have a profound difference on your investment portfolio over the next five to 10 years,” she told news.com.au.

“So don't procrastinate, start today.”

But the lay of the land is more nuanced than that, warns IG market analyst Kyle Rodda, who said equities remain at risky levels given the uncertainty surrounding the reopening of international borders.

He said investors should resist being seduced by companies inflicted with massive losses and are now tantalisingly cheap such as tourism and travel stocks, Flight Centre and Webjet.

The next phase of the recovery will be the splashing of stimulus cash across the globe in an effort to kickstart economies, meaning export equities not restricted by border closures should experience a surge in business.

“While on the aggregate the market is overvalued, there are certain pockets where a savvy investor can take advantage of the change in macroeconomic fundamentals and can still find value,” Mr Rodda told news.com.au.

“And I think that story will be led in the future by the mining sensitive sectors of our economy first and foremost, but also some beaten up areas in the market that are still finding their feet in this recovery which is the consumer discretionary space or real estate.

“It's a time for nuance and careful thinking rather than expecting the whole market to turn around."

HOW TO INVEST IN SHARES

Look for three things when considering investing in a company, says Ms Amir: Is it part of a strong and growing industry, does it make money, and is its debt level low?

But most importantly, stick to what you know.

"Think about those companies that you interact with on a day-to-day basis that you might know something about,” she said.

"Pick about five companies and then go to a broker site and have a look at their research on those stocks and ask yourself are they in a growing industry and are they likely to still be dominating their field in five to 10 years?

“Even if it's a small amount, get started today and invest regularly into the market without trying to time it. Quality companies will always hold their value."

BEST STOCKS

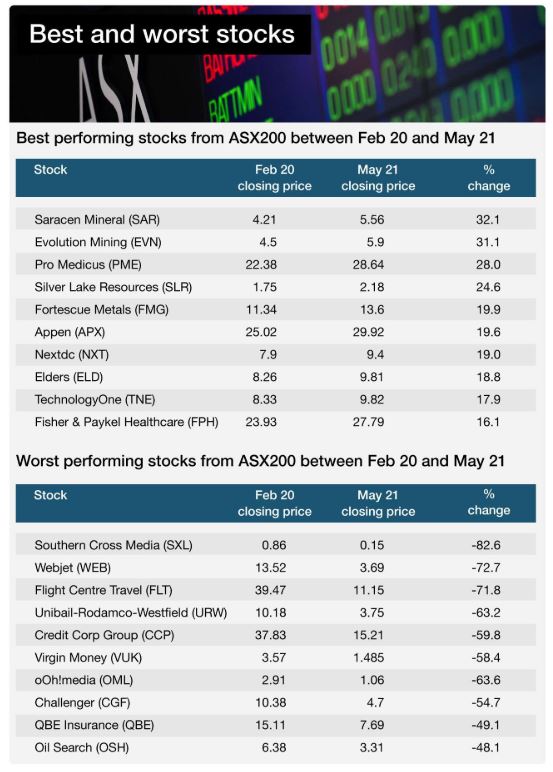

Ms Amir says a handy tool for novice investors plotting a path to riches through the share market is to take a look at the best and worst performing stocks.

The coronavirus pandemic has undermined the indices in the last few months and will likely be the major influence for the foreseeable future.

Since the ASX200 reached its historic peak on February 20, the best performing stocks have been utilities as the lockdown created a reliance on the internet and electricity, healthcare for obvious reasons and consumer staples thanks in part to the infamous stockpiling of supermarket essentials.

But gold miners have dominated as the price of the precious metal rose. Four companies from this industry are in the best performing from the top 200 listed companies in the three months to May 21.

Evolution, Silver Lake and Saracen are all in the top four, surging between 24.6 and 32.1 per cent higher.

Despite the strong returns, Ms Amir says value remains as the precious metal continues to rise.

“It may not be these same four that continue but I definitely expect some gold players to be in the top performers moving forward,” she said.

Technology companies have also outperformed the struggling sector, with Appen, Nextdc and TechnologyOne rising between 19.6 and 17.9 per cent, while Afterpay hit an all-time high of its own this week.

Commodity stocks are tipped to perform strongly. Picture: Brendon Thorne/Getty Images

WORST STOCKS

Unsurprisingly, the falls on the market far exceeded the gains.

Radio specialists Southern Cross Media lost a whopping 82.6 per cent to be worth just 15 cents by Thursday night as businesses cut back on advertising spend during the pandemic. Billboard supplier oOh! media suffered a similar fate, down 63.6 per cent.

Commercial property company Unibail-Rodamco-Westfield took a massive 63.2 per cent hit as retailers were forced to close due to strict social distancing measures, while Webject and Flight Centre plunged more than 70 per cent each as travel became forbidden.

Among this sorry list of worst performers, Ms Amir has singled out Southern Cross Media and Flight Centre as "ones to watch", which were worth just 15 cents and $11.15 at the close of markets on Thursday.

“Flight Centre recently announced a huge restructure, and a big shift to the online world is going to save them a significant amount of cash,” she said.

“That's something that's going to go really well for them; as they drop their costs and the economy recovers and travel returns, their earnings and revenue will rise.

“And for Southern Cross Media, radio and television demand is still there, it's just organisations haven't wanted to fork out to invest in ads.”

Lines snaked around the block for Centrelink sites across the country after the coronavirus took hold. Picture: Sam Ruttyn

FUTURE PROOFING FINANCES

Investing in shares is a luxury hundreds of thousands don’t have after the coronavirus lockdown caused mass job losses.

Nearly 20 per cent of Australians were living week-to-week with their finances before the pandemic, according to a survey from comparison site Finder.

The site’s personal finance expert Kate Browne shared some tips for helping to manage and future proof your finances during the government imposed lockdown.

- Check your credit score: Maintaining a good credit score is wise during this time on the chance you need to turn to financing options down the track. Things that could impact your credit score negatively include missing repayments so if you are in a tight financial position seek help from your bank or financial institution they may be able to give you some breathing room.

- Create a budget: Particularly if your income has been impacted by the coronavirus lockdown. It’s a good idea to take a look at the money you have coming in from work, government payments and investments so you know what you have to work with over the coming months.

- Take a good look at outgoing bills: There are lots of potential savings to be made by reviewing regular costs such as your mortgage or insurance products. For example if you’re not sure if you can continue paying for health insurance now could be a good time to review your cover and see if you can save money by downgrading your cover or switching to a new provider.

- Ask for a discount: Particularly during these trying times providers and lenders are more likely to try to keep you as a customer so don’t be afraid to ask the question.

This article was first published on news.com.